As patent practitioners, our fundamental role is to ensure a client’s intellectual property strategy not only protects their current market position but also secures their future growth. We are tasked with building a durable competitive moat around the company’s most valuable assets. But what happens when the business undergoes a radical strategic pivot, and the IP portfolio remains anchored in the past? Spotify presents a compelling and cautionary case study on the profound risks of such a misalignment.

An analysis of Spotify's business model, its patent portfolio, and the competitive landscape reveals a company building its future on a foundation it does not fully own. For practitioners advising clients on navigating high-stakes market transitions, Spotify’s journey offers critical lessons in strategic foresight, resource allocation, and the imperative of aligning every patent filing with the C-suite’s forward-looking vision.

As patent practitioners, our fundamental role is to ensure a client’s intellectual property strategy not only protects their current market position but also secures their future growth. We are tasked with building a durable competitive moat around the company’s most valuable assets. But what happens when the business undergoes a radical strategic pivot, and the IP portfolio remains anchored in the past? Spotify presents a compelling and cautionary case study on the profound risks of such a misalignment.

An analysis of Spotify's business model, its patent portfolio, and the competitive landscape reveals a company building its future on a foundation it does not fully own. For practitioners advising clients on navigating high-stakes market transitions, Spotify’s journey offers critical lessons in strategic foresight, resource allocation, and the imperative of aligning every patent filing with the C-suite’s forward-looking vision.

Part I: The Fundamental Economic Mismatch

To understand Spotify's strategic pivot, you must first understand the fundamental economics that separate true "internet tech companies" from everyone else. It’s a distinction that explains why some tech giants print money while others, despite immense popularity, perpetually struggle.

The Zero Marginal Cost Standard

The defining feature of hyper-successful internet technology companies like Google or Meta is their proximity to zero marginal cost. This economic principle is the engine of Silicon Valley’s venture-backed model. It means a company can make an additional, incremental sale without significantly adding to its cost structure.

If Google serves its 100 millionth search result or if Facebook serves another advertisement, the incremental cost to the company is virtually zero. While the fixed costs of building the initial infrastructure—the data centers, the software, the global network—are astronomical, the profitability comes from scale. Getting big leads directly and exponentially to profitability because the cost of serving one more user is negligible. This is the ideal venture outcome: a company where user and revenue growth wildly outpaces cost growth .

This structure is the opposite of companies like Apple, which sells physical goods. For every additional $1,000 iPhone sold, Apple incurs real, significant marginal costs for the components and manufacturing of that specific device.

Spotify’s Unique Dilemma: The Royalty Burden

Spotify, despite selling a digital good, does not fit the zero marginal cost model of its internet peers. Its core content—music—is controlled by a handful of powerful record labels operating as an effective oligopoly.

Because of this market structure, Spotify is shackled by high, fixed marginal costs. For every dollar of revenue Spotify generates, a staggering portion—estimated to be around 70%—must be paid out in royalties to rightsholders, including labels, publishers, and artists.

This isn't a fixed cost that gets smaller as the user base grows; it's a variable cost that scales directly with revenue.

"Scale doesn't really solve a lot of problems for Spotify, right? Because even if they get bigger and they sell to more customers, their marginal costs remain the same. So it's a tough spot to be in."

This creates a "growth trap." While adding millions of users (reaching 696 million Monthly Active Users by Q2 2025) looks impressive, it also proportionally increases the company's single largest expense, severely limiting the path to profitability

To claw back even a sliver of margin, Spotify has had to resort to innovative but controversial programs. One such initiative is "Discovery Mode," where artists and labels can opt-in to have their music prioritized by Spotify's algorithms in exchange for forgoing 30% of their royalty payments for those streams. When a label uses this feature, Spotify’s gross margin on those streams can increase by as much as 17%. This move cleverly shifts a cost center into a profit center, but it also fundamentally alters the company's relationship with creators, turning it from a neutral platform into a powerful gatekeeper that effectively charges for reach.

The Competitive Quagmire

This profitability challenge is compounded by intense competition from colossal, deep-pocketed rivals. Spotify competes fiercely against Apple Music, Google (YouTube Music), and Amazon Music. For these behemoths, music streaming is not a primary business but a strategic component of a much larger ecosystem. Apple Music helps sell high-margin iPhones. Amazon Music is a key feature for its Echo smart speakers and a perk for Prime subscriptions. YouTube Music is an extension of the world's largest advertising platform.

These competitors can afford to operate their music divisions as loss leaders, suppressing subscription prices and putting a hard cap on what Spotify can charge. This creates a pincer movement on Spotify's profitability: its costs are kept high by the music labels, while its prices are kept low by its technology competitors.

Furthermore, Spotify has historically faced egregious competitive disadvantages, particularly the "Apple Tax." When selling subscriptions through the App Store, Apple historically took a 30% revenue share—on top of the ~70% already owed to the record labels. This structure placed Spotify in a position where, for every dollar of subscription revenue, it could potentially lose the vast majority to third parties. While Spotify has successfully fought this, influencing EU regulators to mandate a more equal playing field, the intense competitive pressure remains.

Founders’ Takeaway: If your core product relies on input governed by an oligopoly, achieving profitability through scale alone is highly unlikely. You must engineer a fundamental business model pivot to succeed.

Part II: The Strategic Pivot: Becoming an Ad Company

Given the inescapable economic limitations of music streaming, Spotify's strategic necessity is clear: It must become an advertising company.

Advertising is often described as the "greatest business model" due to its scalability and high margins. This model allows companies like Google and Meta to be insulated from the traditional concepts of cost and margin that plague Spotify. To achieve the scalability and profitability that music streaming subscriptions currently deny it, Spotify must execute this pivot.

To successfully build a world-class digital advertising business and maximize ad revenue, Spotify needs to focus on three critical pillars:

Increase Content Inventory: It must dramatically increase the volume of audio content where ads can be placed without incurring per-stream royalties.

Improve Targeting and Personalization: The better the ad targeting, the more advertisers will bid in an auction-based system. This requires a deep, nuanced understanding of user behavior.

Measure ROI: It must effectively prove Return on Investment (ROI) for advertisers. In a world increasingly focused on user privacy, particularly after Apple's App Tracking Transparency (ATT) initiative made cross-app tracking difficult, this is a critical and technically challenging differentiator.

Acquiring Zero Marginal Cost Content

Since music has fixed costs, the company must shift its focus to content that has zero marginal cost.

Podcasts: Spotify has invested billions in this space, making major acquisitions like the podcasting companies Gimlet Media and Anchor FM, and famously signing an exclusive deal for The Joe Rogan Experience. Though some of these acquisitions were criticized for a lack of true exclusivity or questionable execution, the overarching strategy was to establish Spotify as the dominant platform for podcasts, which offer a vast and highly scalable inventory for ads. The strategy, despite some bumps, has largely worked: Spotify has successfully unseated Apple as the number one platform for podcast listening globally.

Audiobooks: In late 2022, Spotify made a decisive entry into the audiobook market with the acquisition of distributor Findaway. It then introduced an innovative business model, offering Premium subscribers a set number of listening hours per month rather than forcing the purchase of an entire $24+ book. This significantly reduced the barrier to entry, attracting more users and rapidly growing its catalog to over 400,000 titles. This move is already paying dividends, with over 25% of Premium users now listening to audiobooks and the U.S. audiobook market growing by 23% in 2024, with Spotify playing a significant role in that growth.

The Advertising Advantage

Spotify holds a unique competitive advantage over traditional ad platforms: the ability to serve songs as ads.

Unlike on Google or Facebook, where ads are often a jarring interruption, Spotify can serve music as an ad, creating a seamless and even positive experience for the user (e.g., helping them discover a new artist). This is a powerful form of native advertising. While this "pay-to-play" model has generated controversy among artists who feel pressured to pay for promotion, the core advantage remains: the ad content is intrinsically linked to the platform's core offering, making it feel less like an intrusion and more like a discovery.

Part III: The Founder's Mandate: Strategic IP Allocation

If Spotify's future lies entirely in being a high-margin ad company, its patent strategy must reflect that. For tech founders, this is the most critical question: Where should your R&D and IP budget be allocated when executing a strategic pivot?

The Hypothetical, Correct IP Strategy

If we were advising Spotify on its forward-looking IP portfolio, we would mandate a radical reallocation of resources to build a fortress around its future business.

Ad Targeting, Personalization, and AI/ML (60%): This is the future revenue driver. Patents must aggressively protect the proprietary models used to analyze Spotify's vast trove of first-party data—listening history, playlist additions, song skips, time-of-day patterns—to improve ad relevance and compute ROI for advertisers. After Apple’s ATT initiative, companies can no longer easily track conversions across apps. Therefore, AI and machine learning models that extract data points and predict purchases based on ad exposure are essential and must be protected vigorously.

UI/UX Differentiation (15%): Spotify is "best-of-breed" in streaming experience, and this creates a sticky product. While historically important, continued investment should focus only on patents that lock in key UI/UX benefits—like the algorithms behind "Discover Weekly" or the seamless multi-device experience of Spotify Connect—and prevent major competitors from encroaching on the core user experience

Ad Distribution Infrastructure (15%): Patents are needed for the "nuts and bolts" of ad delivery, especially in complex areas like dynamically inserting personalized ads into static files (such as pre-recorded podcasts).

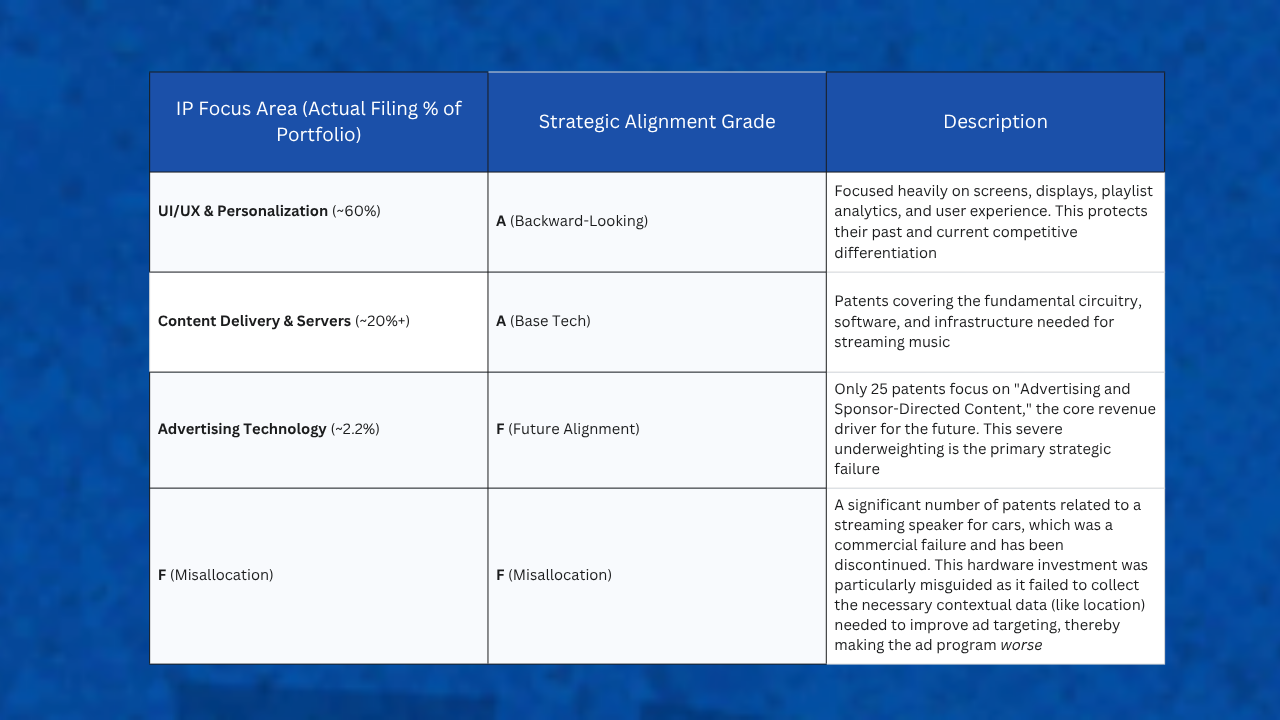

The Reality: Spotify’s Misallocated Portfolio

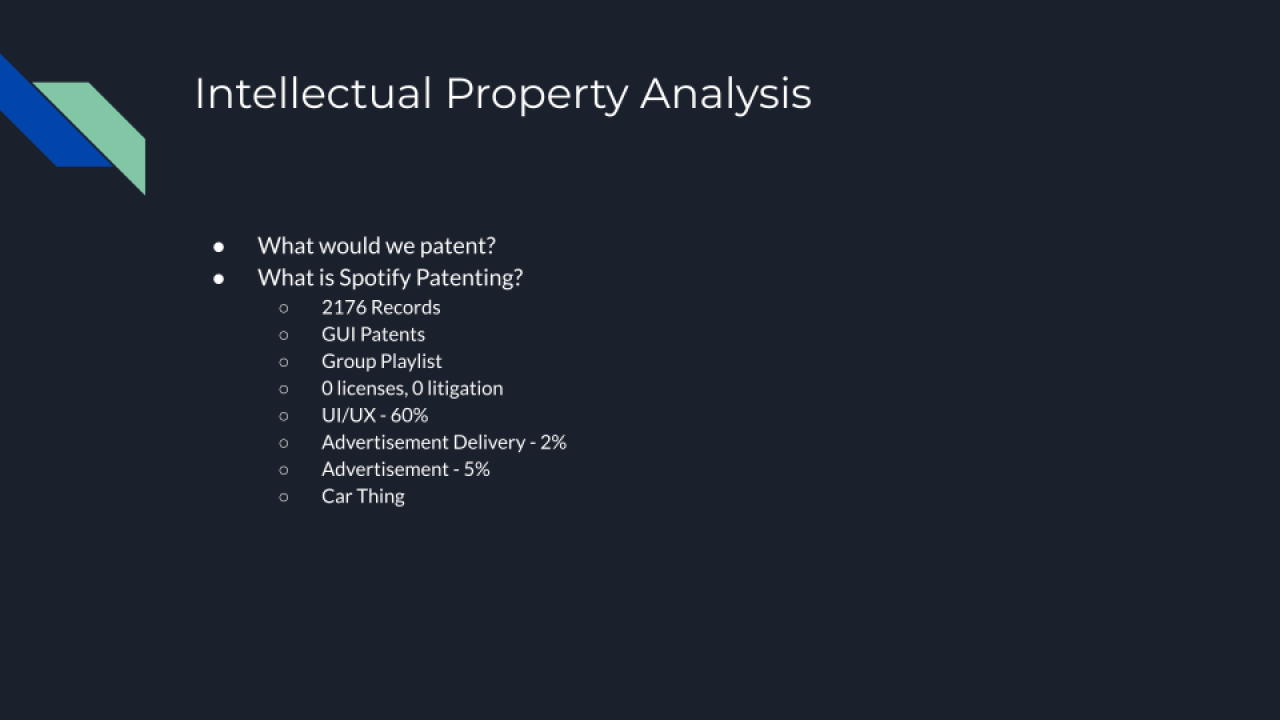

Spotify has a manageable portfolio of approximately 1,200 global patents belonging to around 450-500 unique patent families. A review of these filings reveals a critical, and potentially fatal, strategic misalignment.

The IP Gap: No Moat Around the Future Cash Cow

The most damning finding is the failure of the portfolio to align with the forward-looking business plan. Spotify wants to be an ad company, yet a shockingly low 2.2% of its IP is focused there.

This creates a massive vulnerability that founders must avoid:

If Spotify invests millions in R&D and stumbles upon a highly profitable system for serving audio ads, competitors like Apple Music and Amazon Music can legally replicate that entire system without fear of infringement, because Spotify failed to patent it. Spotify risks becoming the unpaid R&D lab for its wealthiest competitors.

The few ad-related patents that were filed are often poorly conceived. One infamous patent describes a system for using a device's microphone to listen to a user's ambient environment and emotional state to serve music recommendations. While technically innovative, this risks a massive PR nightmare ("Spotify is spying on you") and may not be worth the risk of public backlash.

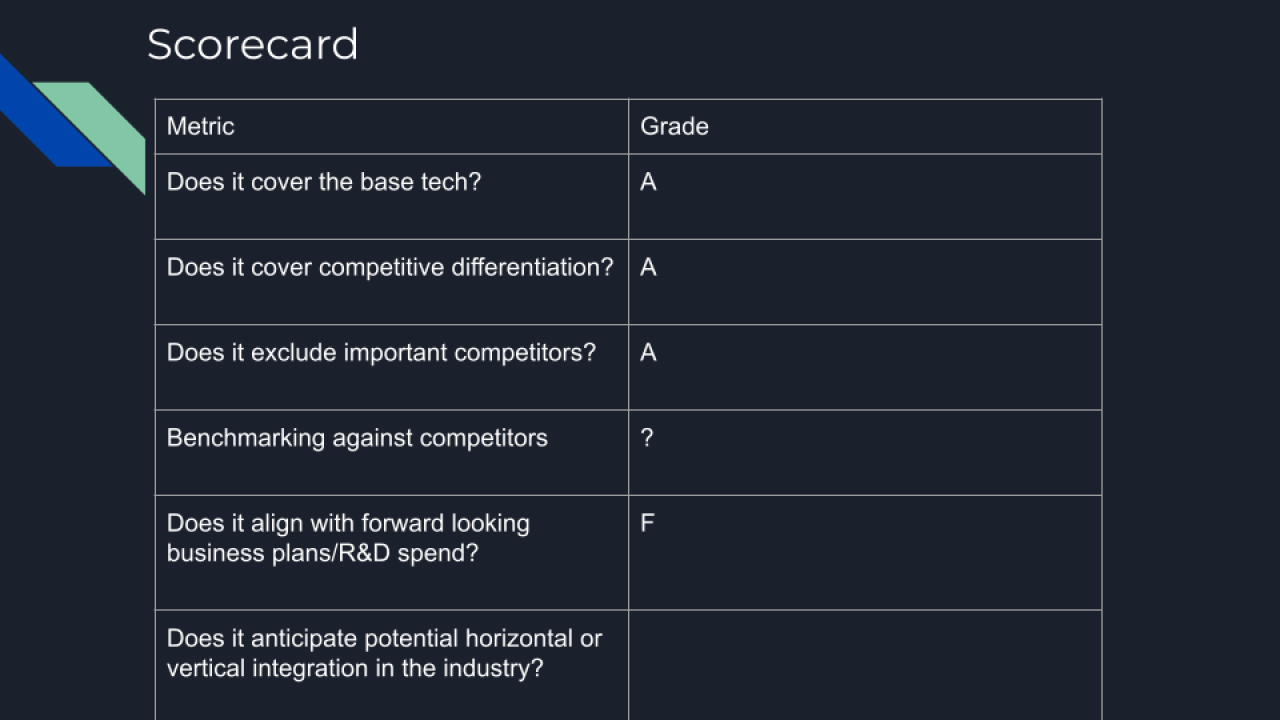

Part IV: The Patent Strategy Scorecard: Grading the Performance

Using the Scorecard methodology, we can formally evaluate Spotify's IP strategy. The results are a stark illustration of a portfolio built for a different war.

Metric 1: Does it cover the base technology? (Grade: A)

Spotify receives a good grade here. Its early patents successfully cover the foundational aspects of content delivery, using clever peer-to-peer systems to ensure stable streaming, and the server infrastructure necessary to run a global service.

Metric 2: Does it cover competitive differentiation? (Grade: C)

This grade reflects a dangerous dichotomy. The portfolio earns an 'A' for protecting Spotify's historical point of differentiation: its best-in-class UI/UX. The massive investment in patents for features like "Discover Weekly," collaborative playlists, and seamless multi-device playback ensures protection for the features that make the product sticky. However, it earns an 'F' for protecting its future and most critical differentiator: its emerging advertising platform. The average results in a cautionary 'C'.

Metric 3: Does it exclude important competitors? (Grade: C)

Similar to the metric above, while Spotify can likely exclude competitors from directly copying its unique user interface, it fails catastrophically in excluding them from the only viable path to profitability: ad technology. Because the ad platform IP is so weak, competitors can easily copy successful monetization systems. This low grade reflects the potential for competitors to free-ride on Spotify's ad R&D efforts.

Metric 4: Benchmarking Against Competitors (Grade: F)

While it may seem unfair to compare Spotify to tech giants, founders must understand the scale of the IP war chest required to compete. Spotify's ~1,200 patents are dwarfed by its rivals,

Google/YouTube has more than ten times the number of patents as Spotify, with a substantial portion of its portfolio dedicated entirely to advertising—exactly where Spotify needs to go. Even Netflix, a closer analog, has a larger portfolio that is laser-focused on solving its core technical challenge of video delivery—a strategic alignment Spotify lacks.

Metric 5: Does it align with forward-looking business plans? (Grade: F)

This is the most critical metric, and Spotify fails definitively. The stated business objective is to become a scalable, ad-driven company. The actual IP allocation ignores this reality, focusing instead on past achievements (UI/UX) and failed hardware experiments like the Car Thing. Dedicating only ~2.2% of your patent portfolio to your future revenue engine is a strategic blunder.

Metric 6: Does it anticipate potential horizontal or vertical integration? (Grade: D)

This metric assesses whether the IP covers intersection points in the industry. Vertical integration involves covering all layers of content delivery—from acquisition and processing to distribution on specific devices. Spotify’s only significant vertical integration filing appears to be for the failed Car Thing, a physical device that was discontinued just five months after launch and remotely "bricked" in December 2024, turning it into e-waste. As AI becomes central to user experience, the patents at the intersection of AI-driven curation and content delivery will be key. The current portfolio shows little evidence of this forward thinking.

Part V: Actionable Takeaways for Tech Founders

The Spotify case study provides potent, hard-won lessons for founders managing growth, pivots, and IP strategy:

1. Identify and Protect Your Future Revenue Engine (The Moat)

If you are currently a subscription (SaaS) business but know that your ultimate profitability will rely on a secondary, higher-margin model (e.g., advertising, marketplace transactions, data services), your IP strategy must prioritize that future model immediately. Spotify’s competitive moat for music streaming (UI/UX) is strong, but that moat doesn't protect the path to profitability (advertising).

2. Guard Against R&D Boondoggles

Founders must ruthlessly evaluate R&D expenditures not just on commercial viability, but on strategic alignment. The investment in the "Car Thing" was a dual failure: it wasted substantial R&D and patent spend, and it was a hardware device that actively hindered the collection of crucial contextual data needed for the core ad business. Every patent filed must support the central mission. A project that doesn't advance your primary strategic goal is a dangerous distraction, no matter how innovative it seems in isolation.

3. Embrace AI/ML IP for Modern ROI Calculation

The ability to compute ROI for advertisers is paramount in the digital ad economy. With privacy rules (like Apple's ATT) making cross-app tracking difficult, the need for sophisticated AI and ML models to infer user behavior and purchase intent is critical. Founders must dedicate significant IP resources to protecting these models, which form a powerful competitive differentiator in targeted advertising. Spotify's recent launch of the Spotify Ad Exchange and adoption of identity solutions like UID 2.0 shows they understand this, but their patent filings have yet to catch up.

4. Be Proactive on Vertical Integration and Intersections

Look ahead to where technology and business models will inevitably converge. For Spotify, this means the intersection of AI-driven user experience and content delivery. Patents filed at these vertical integration points—for example, how content acquisition, processing, and distribution are optimized by an end-to-end AI system—tend to become highly valuable and future-proof the business. Don't just patent individual features; patent the system that connects them.

Conclusion

Spotify's history is a powerful illustration of the consequences of an IP strategy that is backward-looking. While its leadership correctly identified the need to transition from a fixed-cost content delivery system to a zero-cost ad engine, their failure to dedicate sufficient patent protection to that new engine leaves their future profitability vulnerable to free-riding competitors.

As a founder, ensure that your patent budget reflects where you need to win in the next five years, not just where you have been winning historically. Align your IP spend with your strategic pivot to build an impenetrable moat around your path to long-term profitability.